Operating ratio is also a common term in the insurance business where it refers to an issuer s profit from underwriting and investment activities. 27102020 Operating ratio is the ratio of operating expenses to net sales.

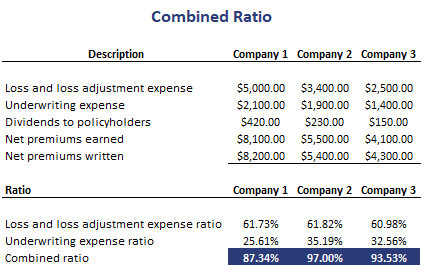

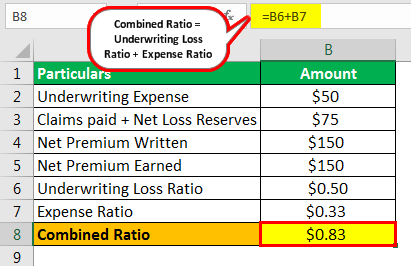

Combined Ratio Breaking Down Finance

Combined Ratio Breaking Down Finance

Insurance Term - Operating Ratio IRIS It is the combined ratio less the net investment income ratio net investment income to net premiums earned.

Insurance operating ratio. When a companys operation ratio is low it means that it has managed to come up with a good operational budget while also remaining profitable. Overall Operating Ratio A ratio to show the insurers pre-income tax profitability taking into account investment income. The combined ratio also called the combined ratio after policyholder dividends ratio.

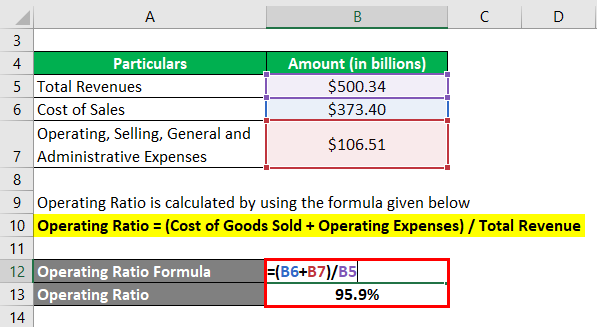

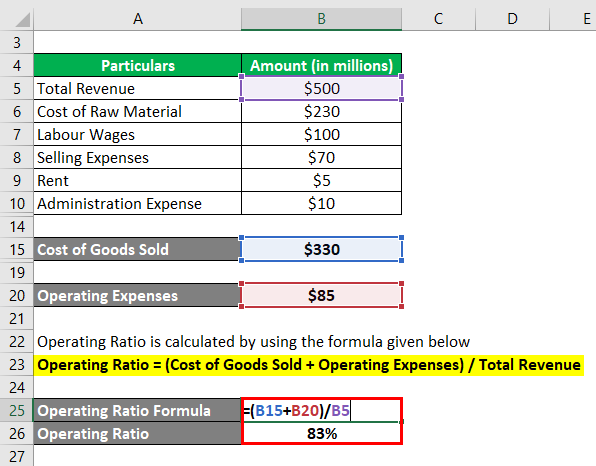

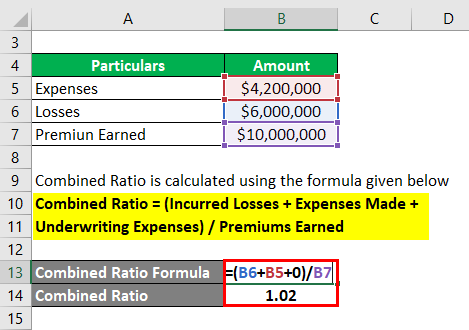

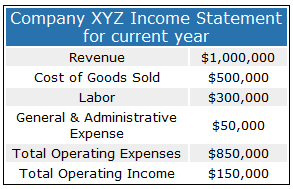

It includes total expenses as a percent of total income before adjustments for federal taxes. 01092019 Operating Ratio is calculated using the formula given below Operating Ratio Cost of Goods Sold Operating Expenses Total Revenue Operating Ratio 37340 billion 10651 billion 50034 billion Operating Ratio 9592. 11072017 A combined ratio of more than 100 means that an insurance company had more losses plus expenses than earned premiums and lost money on its operations.

Property and casualty insurance industry was 89 percent and remained at that level through the first quarter of. Overall Operating Ratio a ratio to show the insurers pre-income tax profitability taking into account investment income. Operating ratio also known as operating cost ratio or operating expense ratio is computed by dividing operating expenses of a particular period by net sales made during that period.

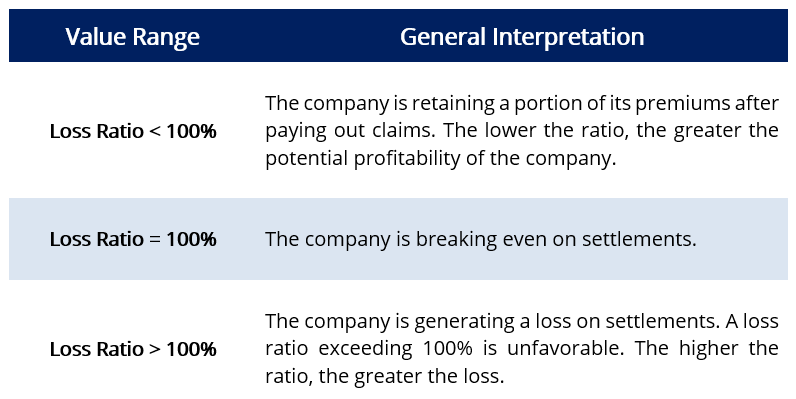

19112020 In 2018 the operating ratio of the US. Financial charges such as interest are normally excluded from operating expenses. Conversely a combined ratio of less than 100 means that a company had more earned premiums than losses plus expenses and is operating in the black while a combined ratio of exactly 100 is the break.

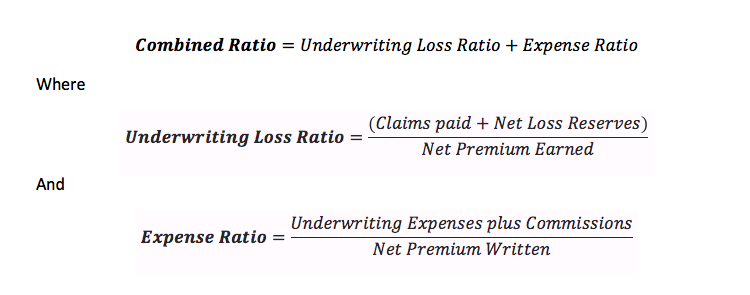

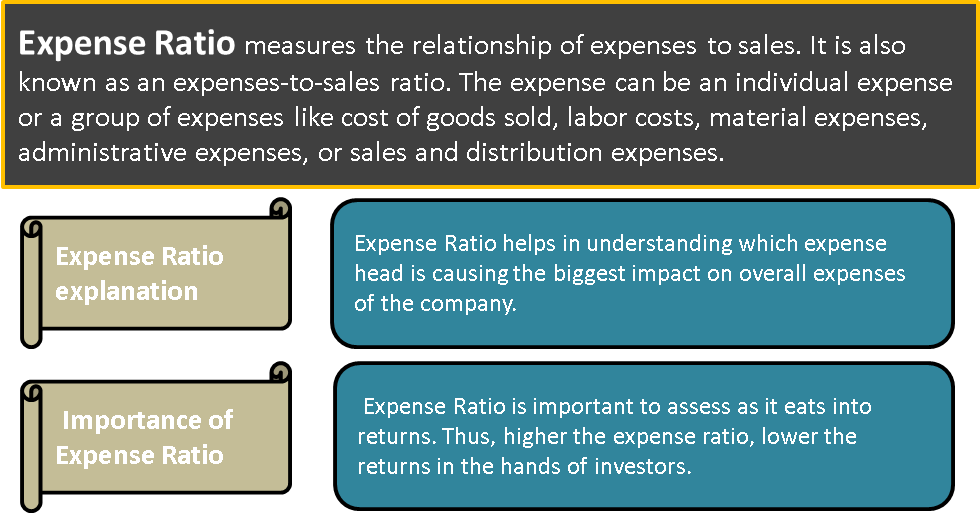

Expense ratio for an insurer would be analysed by class of. In other words the cost of operating an insurance company shown in comparison to the percentage of sales is known as the Expense Ratio. 24022020 In laymans terms the formula to get the Expense Ratio is dividing the expenses of the insurance company by Net Premium Earned.

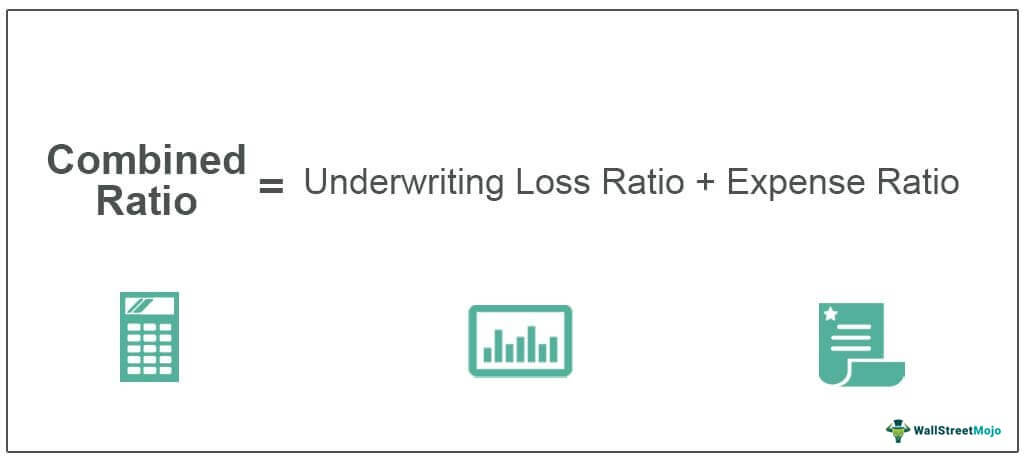

Ratio is a reflection on the nature of risk underwritten and the adequacy or inadequacy of pricing of risks Expense Ratio Management Expenses - Net commission paid earned x 100 Net Premium Earned Expense ratio reflects the efficiency of insurance operations. Is a measure of profitability used by an insurance company to gauge how well it is performing in its daily. 18082020 A combined ratio CR is the measure of underwriting profitability in insurance calculated using the sum of incurred losses and expenses divided by earned premiums.

A ratio 095 -to 1 means that insurers are writing less than 100 worth of premium for every 100 of surplus. 10112016 Insuranceopedia Explains Operating Ratio. On the flipside a combined ratio of more than 100 represents an underwriting loss which means an insurer is reliant on investment income to square the ledger.

We hope the you have a better understanding of the meaning of Overall Operating Ratio. If on the other hand the ratio is high it means that it has not done its budgeting well and has managed its financial resources poorly. Like expense ratio it is expressed in percentage.

Operating expenses normally include administrative costs office expenses and selling and distribution costs. Insurers can have an underwriting loss a CR of more than 100 percent but still be profitable because of investment income levels. 07102010 An Operating Ratio is a means of monitoring the efficiency of a business in terms of its operating expenses against net sales.

It includes total expenses as a percent of total income before adjustments for federal taxes. 24092010 A combined ratio below 100 means an insurance company is operating at an underwriting profit a profit before adding the returns from investing customers premiums. A ratio of 102-to-1 means insures are writing about 102 for.

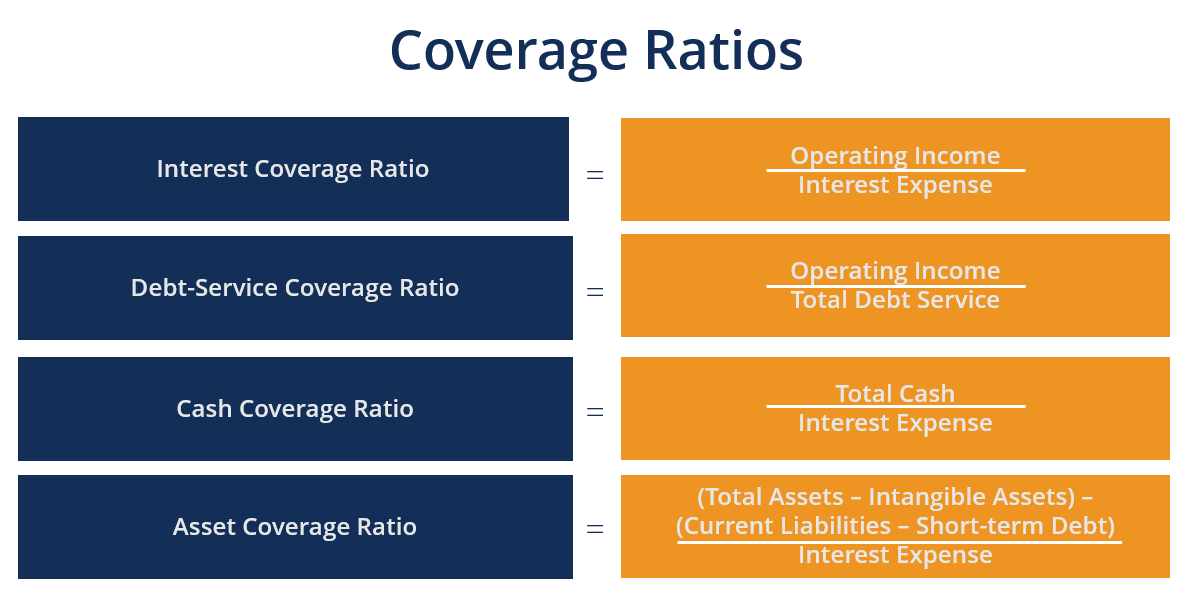

Coverage Ratio Guide To Understanding All The Coverage Ratios

Coverage Ratio Guide To Understanding All The Coverage Ratios

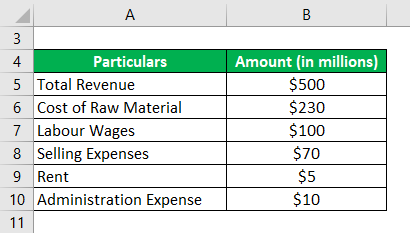

Operating Ratio Top 3 Different Examples Of Operating Ratio

Operating Ratio Top 3 Different Examples Of Operating Ratio

Operating Ratio Top 3 Different Examples Of Operating Ratio

Operating Ratio Top 3 Different Examples Of Operating Ratio

Combined Ratio Benefits And Limitations Of Combined Ratio

Combined Ratio Benefits And Limitations Of Combined Ratio

Operating Ratio Top 3 Different Examples Of Operating Ratio

Operating Ratio Top 3 Different Examples Of Operating Ratio

Operating Ratio Top 3 Different Examples Of Operating Ratio

Operating Ratio Top 3 Different Examples Of Operating Ratio

Loss Ratio Overview Formula Purpose And Interpretation

Loss Ratio Overview Formula Purpose And Interpretation

What Is The Business Revenue Model For Insurance Companies

What Is The Business Revenue Model For Insurance Companies

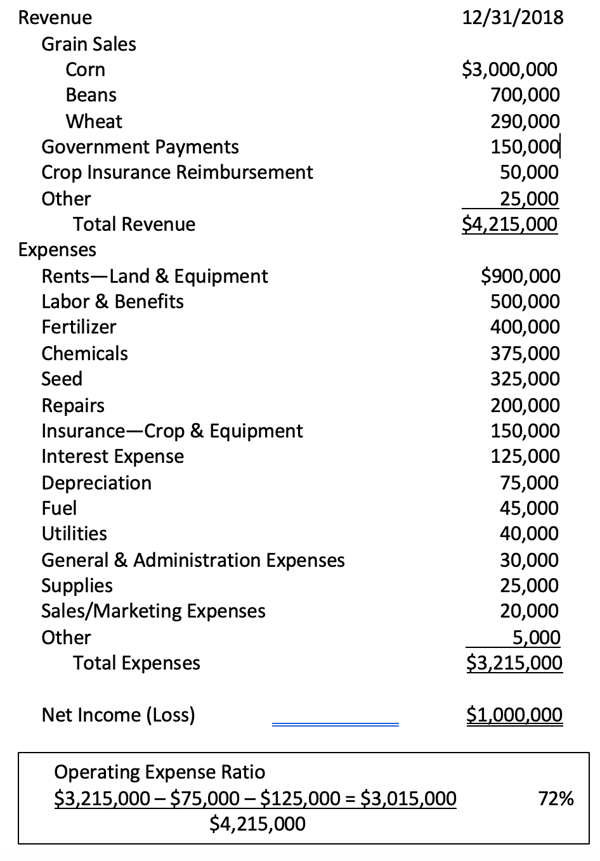

What Is The Operating Expense Ratio And Why Does It Matter

What Is The Operating Expense Ratio And Why Does It Matter

Loss Ratio Formula Calculator Example With Excel Template

Loss Ratio Formula Calculator Example With Excel Template

Combined Ratio In Insurance Definition Formula Calculation

Combined Ratio In Insurance Definition Formula Calculation

Combined Ratio Definition And Meaning Market Business News

Combined Ratio Definition And Meaning Market Business News

Combined Ratio Benefits And Limitations Of Combined Ratio

Combined Ratio Benefits And Limitations Of Combined Ratio

Operating Expense Ratio Formula Calculator With Excel Template

Operating Expense Ratio Formula Calculator With Excel Template

Combined Ratio Formula Calculation Example Analysis Definition

Combined Ratio Formula Calculation Example Analysis Definition

Operating Ratio Definition Example Investinganswers

Operating Ratio Definition Example Investinganswers

Combined Ratio In Insurance Definition Formula Calculation

Combined Ratio In Insurance Definition Formula Calculation

Operating Ratios Or Expense To Sales Ratios Formula Example Importance Behavior

Operating Ratios Or Expense To Sales Ratios Formula Example Importance Behavior

Posting Komentar

Posting Komentar