Lets say one of the big five banks are exempt from GSTHST for most of their services they offer eg. Importantly the business is also not eligible to claim Input Tax Credits for any HST paid because there was no HST paid.

Gst Harmonized Sales Tax Hst Trips And Traps For Privately Owned Businesses Tax Canada

Gst Harmonized Sales Tax Hst Trips And Traps For Privately Owned Businesses Tax Canada

Substantial renovations are defined as the removal or replacement of most of the building except for the roof walls foundation and floors - see the CRAs B-092 Substantial Renovations and the GSTHST.

Insurance hst exempt. 12041991 Part 1 - INSURANCE PRODUCTS AND SERVICES GENERAL Exempt Products and Services. 30112018 Applewood did not charge GSTHST on its sale of the insurance products and instead treated those sales as exempt supplies of agreeing to provide or arranging for a financial service. 07062018 Financial services are generally an exempt supply for which no GSTHST would be charged.

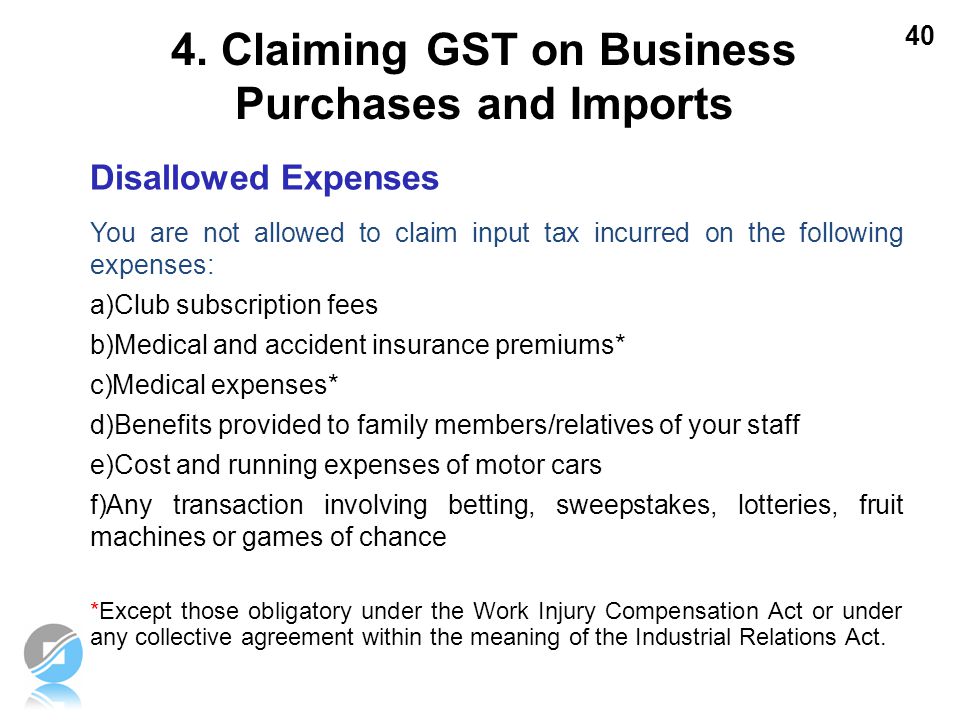

However the ITC on the motor vehicles will only be allowed when used for further supply of vehicles or. Rules after Implementation of HST. HST Exempt means that HST is not charged at all on the goods or services provided.

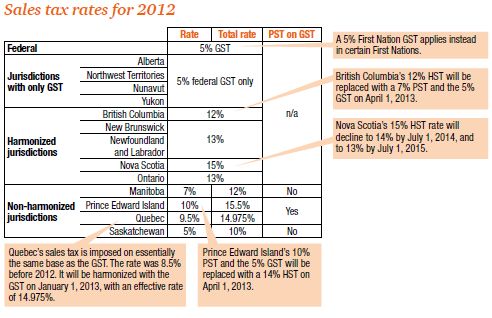

By being exempt I believe this also means these financial institutions cannot claim ITC. That is these items are considered taxable but the tax rate is zero. However it retained its PST of 8 percent on insurance premiums as before.

23062020 GST paid on general insurance is available if expense is for the business purpose. 13072015 Therefore it is a question of fact whether they make supplies for GSTHST purposes and whether those supplies are exempt taxable or zero-rated. These zero-rated items include things such as.

6 HST taxable although some could be HST-exempt if provided by a public service body to children age 14 and under and underprivileged individuals with a disability. Includes underwriting transfer of ownership payment of dividends and claims and other policy related transactions. What Does HST Exempt Mean.

The supplier of the financial services would also not be entitled to claim input tax credits ITCs for any GSTHST incurred on their inputs. 16082014 Specifically if an insurer to whom real property has been transferred in the course of settling an insurance claim ie in circumstances in which subsection 1841 applies begins at any time to use the property otherwise than in the making of a supply of the real property the insurer is deemed to have made a supply of the property at that time and except where the supply is an exempt supply the insurer is deemed to have collected at that time GSTHST equal to the amount determined. 7 HST taxable although some could be exempt if maximum admission charged by a public service body is 1 or less if the admissions.

Issues and processes an insurance policy. 1-1 Individual Insurance Policy General Description. 06032021 Some examples of GSTHST exempt goods and services are.

Taxable goods and services for purposes of GST and HST include items which are zero-rated. Sometimes learning bookkeeping means phoning CRA. Applewood objected to the reassessments which could not be resolved at the CRAs appeal stage and eventually landed at the Tax Court of Canada and before the Honourable Justice Pizzitelli.

When Ontario joined the HST system on July 1 2010 it substantially eliminated its PST on goods and services. 23112015 Insurance premiums in general are exempt from the federal Goods and Service Tax GST as they are considered financial services. Where an insurance agent or broker provides an arranging for financial service the service is exempt under Part VII of Schedule V unless it is specifically zero-rated under section 1 of Part IX of Schedule VI.

It is not collected by the business and the business does not have to remit HST from that purchase on their HST return. Refundable or rebatable PST. Providing a supply of a financial service under paragraph l of arranging for.

Rules after implementation of HST As a result of the introduction of HST in July 1 2010 the Ontario government announced that it would continue its application of tax at the rate of 8 percent on the same types on insurance premiums that were. As of July 1 2015 products marketed exclusively for feminine hygiene purposes. I understand Financial Institutions eg.

To a Canadian resident in consideration for premiums or other fees. Purchases you made outside Canada that are not subject to the GSTHST. Used residential housing GSTHST is only charged on new or substantially renovated.

23092010 Insurance premiums in general were also exempt from the federal Goods and Service Tax GST as they are considered financial services. The reason the premiums are exempt from these taxes is that the premiums are considered to be financial services and as such are not taxable in any category of taxes for Ontario. HST and Insurance Commissions January 2019 CRA not appealing Tax Court ruling that insurance commissions are HST-exempt As announced CADA in partnership TADA and our provincial association colleagues supported a major case before the Federal Tax Court that culminated in a favourable dealer ruling on November 15thof this year.

So GST on insurance premium paid for factory building motor vehicle fire insurance etc will be eligible for Input Tax Credit ITC. A service referred to in any of paragraphs a to i and not referred to in any of paragraphs n to t the insurance agent or broker is not eligible to claim ITCs for the GSTHST paid or payable on property or services that were acquired or imported for the purpose of making exempt. Expenses on which you have not paid the GSTHST such as employees salaries insurance payments interest exempt or zero-rated purchases and purchases from a non-registrant.

Where an insurance agent or brokers activities are limited to making exempt supplies eg. When it comes to the Federal Goods and Services Tax GST there is also no taxes levied on the premiums for car insurance.

Is Car Insurance Subject To Hst In Ontario Ratelab Ca

Is Car Insurance Subject To Hst In Ontario Ratelab Ca

Https Www Cdhowe Org Sites Default Files Attachments Research Papers Mixed Commentary 20522 Pdf

Https Financial Affairs Mcmaster Ca App Uploads 2018 10 Mcmaster University Booklet Combined Pdf

Canadian Life And Health Insurance Hst On Insurance And Investments

Canadian Life And Health Insurance Hst On Insurance And Investments

Hst Exempt Items Services What Items Are Hst Exempt Ontario Taxation Blog

Hst Exempt Items Services What Items Are Hst Exempt Ontario Taxation Blog

Car Dealership S Sale Of Insurance Products Held To Be Gst Hst Exempt Insurance Canada

Car Dealership S Sale Of Insurance Products Held To Be Gst Hst Exempt Insurance Canada

Improving The Hst Audit Process Tvh Et Audits On Cherche A Ameliorer Le Processus

Improving The Hst Audit Process Tvh Et Audits On Cherche A Ameliorer Le Processus

Hst And Insurance Commissions Tvh Et Des Commissions Sur Les Produits D Assurance

Hst And Insurance Commissions Tvh Et Des Commissions Sur Les Produits D Assurance

Insurance Foreign Worker Insurance Can Claim Gst

Insurance Foreign Worker Insurance Can Claim Gst

Understanding The Ins And Outs Of Itcs Canadian Condominium Institute Toronto Chapter Cci T

Understanding The Ins And Outs Of Itcs Canadian Condominium Institute Toronto Chapter Cci T

Is Car Insurance Subject To Hst In Ontario Ratelab Ca

Is Car Insurance Subject To Hst In Ontario Ratelab Ca

.png.aspx) If You Are A Medical Practitioner Are You Required To Be Registered For Gst Hst And Qst Bdo Canada

If You Are A Medical Practitioner Are You Required To Be Registered For Gst Hst And Qst Bdo Canada

Insurance Foreign Worker Insurance Can Claim Gst

Insurance Foreign Worker Insurance Can Claim Gst

Is There Tax On Auto Insurance In Ontario Complete Car

Is There Tax On Auto Insurance In Ontario Complete Car

Https Www Coughlin Ca Uploads Publications C Special Courier 0710 E Pdf

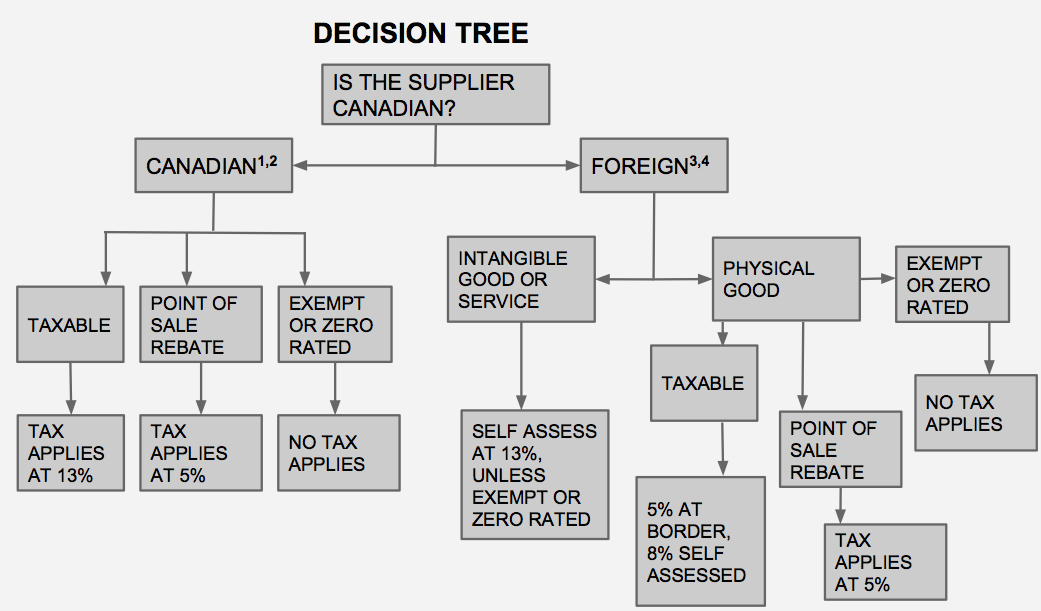

Hst For Procurement Financial Services

Hst For Procurement Financial Services

Hst A Taxing Issue Canadian Underwriter Canadian Underwriter

Hst A Taxing Issue Canadian Underwriter Canadian Underwriter

Is Car Insurance Subject To Hst In Ontario Ratelab Ca

Is Car Insurance Subject To Hst In Ontario Ratelab Ca

Indirect Tax Harmonized Sales Tax Primer For Public

Indirect Tax Harmonized Sales Tax Primer For Public

Posting Komentar

Posting Komentar