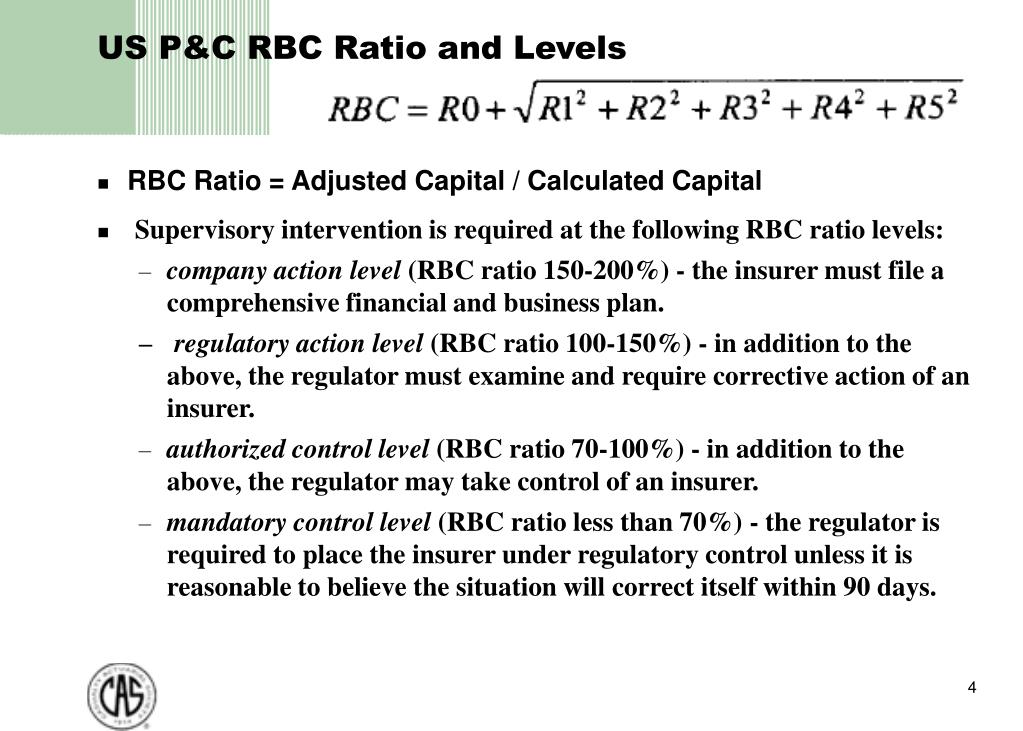

1 Company Action Level RBC means with respect to any insurer the product of 20 and its Authorized Control Level RBC. It requires a company with a higher amount of risk to hold a higher amount of capital.

Rbc Rewards Visa Preferred The Point Calculator Top Credit Card Reward Card Rewards

Rbc Rewards Visa Preferred The Point Calculator Top Credit Card Reward Card Rewards

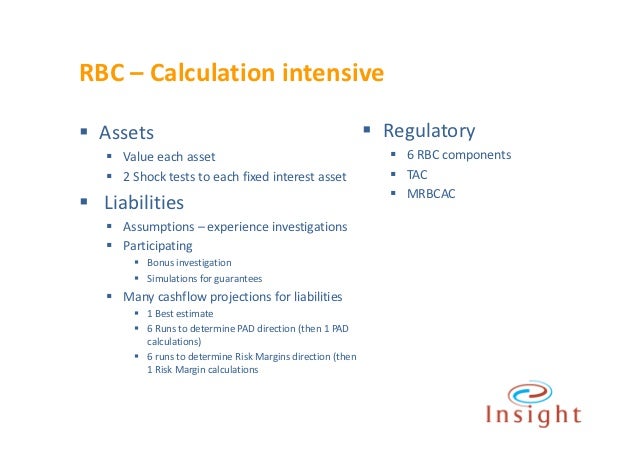

The formula tries to capture all the material risks that are common to the particular type of insurance.

Insurance rbc calculation. Semakin besar tingkat RBC sebuah Perusahaan Asuransi maka bisa dikatakan semakin sehatlah kondisi finansial Perusahaan Asuransi tersebut. As the Standard Formula is not final this paper deals with the Standard Formula as presented. Ii Highlight some of the potential implications for businesses arising from the future development of capital regulations.

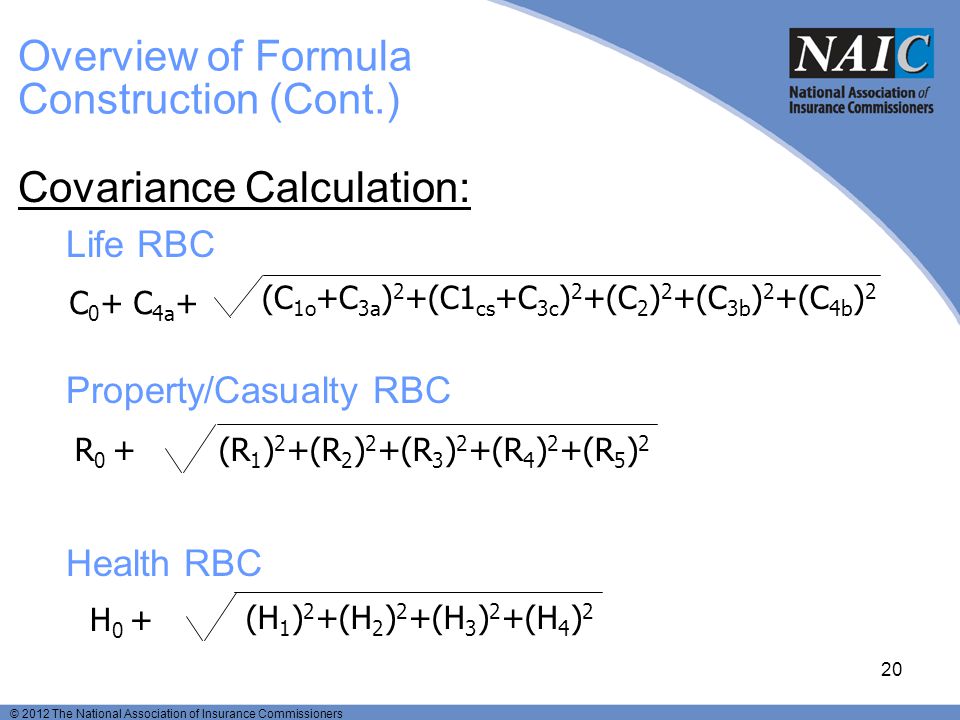

NAIC Risk Based Capital RBC Ratio Authorized Control Level RBC 05 x Total RBC Requirement Total RBC Requirement R 0 R 1 2 R 2 2 05R 3 2 05R 3R 4 2 R 5 2 6 categories of capital charges R 0Off Balance Sheet R 1 Fixed Income Securities R 2 Equity Securities R 3 Credit R 4 Loss and LAE Reserves R. Risk-Based Capital RBC Ratios 3 negative RBC total could result from either of the four elements. RBC limits the amount of risk a company can take.

Risk-Based Capital RBC is a method of measuring the minimum amount of capital appropriate for a reporting entity to support its overall business operations in consideration of its size and risk profile. In the National Association of Insurance Commissioners NAIC Risk-Based Capital RBC formula. Because RBC involves squaring the first three items and then taking the square root overall the final result cannot be negative.

Component 2 C2 requirement. C-1 for asset risk C-2 for claims C-3 for disintermediation or the C-4 business risk. The calculation of these risk charges has still to be set.

This report aims to. This is a confidential tool and is restricted to those users with assigned permissions.

05052016 Dewasa ini istilah Risk Based Capital atau rasio solvabilitas RBC telah menjadi penting khususnya berkaitan dengan pengukuran kesehatan finansial perusahaan asuransi. The report also lists key elements used in determining the Trend Test result from the RBC calculation. This component relates to risks inherent in an insurers asset portfolio.

28022020 Notice 133 has also been issued following the RBC 2 review and comprises both mandatory requirements and guidelines on the supervisory intervention levels valuation of policy liabilities in respect of life business and general business and the calculation of the total risk requirements and financial resources. Visit RBC Insurance today to try our easy Life Insurance Calculator and quickly figure out how much life insurance you need. For companies that fall in the 200 to 250 of Authorized Control Level ACL the test subtracts from the current level the larger of the decrease in margin the amount above.

2 Regulatory Action Level RBC means the product of 15 and its Authorized Control Level RBC. Requirements BSCR Canadas Life Insurance Capital Adequacy Test LICAT and the United States RBC regime US RBC. For life insurance business the requirement is calculated by applying specific risk margins to key parameters affecting policy liabilities such as mortality morbidity expenses and policy termination rates.

Challenges and Opportunities 08 Life and General Insurers No change has been made to the calculation of C3 risk charge or the limits of the C3 amount. Specifically the tool displays those companies that trigger a Company Action Level event based on the result of the Trend Test. Key ProposalsChanges Under RBC1 and QIS1 the C3 risk charge was added to the other risk charges to calculate the total risk requirement.

Risk Based Capital Ratio RBC ratio is calculated by dividing the total adjusted capital of the company by required Risk Based Capital. D The filing by the insurer of an RBC report indicating that the insurer has total adjusted capital that is greater than or equal to its company action level RBC but less than the product of three point zero and its authorized control level RBC and with a combined ratio greater than one hundred twenty percent as determined in accordance with the trend test calculation in the RBC. A separate RBC formula exists for the three primary types of insurance life propertycasualty and health but while the risk components may differ the formulation is exactly the same.

Calculates its Solvency CapitaRequirement l SCR using a Standard Formula an internal model or some combination of the two. Ew Risk Based Capital ramework for Insurers in Singapore. 3 Authorized Control Level RBC means the number determined under the risk-based capital.

I Compare and contrast life insurance RBC regimes across selected Asian markets. 17062014 Background on RBC cont RBC calculation is based on statutory accounting principles whose goal is to protect policyholders Required capital calculation assumes a going concern not a liquidation environment Required capital is an add-on to policy reserves under the assumption that policy reserves are adequate. The life insurance type trend test supplements the RBC calculation by looking at the trend in RBC results for a company.

However since these risks have not been considered in RBC calculations so far this will lead to an increase in the base capital requirement calculation. The proposal is that TRR will include elements for credit spread risk insurance catastrophe risk and operational risk.

Risk Based Capital In Sri Lanka Making It Happen

Risk Based Capital In Sri Lanka Making It Happen

Mobile Decice Insurance Details Cards That Offer It Business Credit Cards Bank Rewards Hotel Card

Mobile Decice Insurance Details Cards That Offer It Business Credit Cards Bank Rewards Hotel Card

Evolution Of Rbc System In The Usa Ppt Download

Evolution Of Rbc System In The Usa Ppt Download

Risk Based Capital For Insurers The U S System Ppt Download

Risk Based Capital For Insurers The U S System Ppt Download

Risk Based Capital For Insurers The U S System Ppt Download

Risk Based Capital For Insurers The U S System Ppt Download

Signature Rbc Rewards Visa The Point Calculator Visa Card Visa Reward Card

Signature Rbc Rewards Visa The Point Calculator Visa Card Visa Reward Card

Cibc Aventura Gold Visa Card The Point Calculator Gold Visa Card Visa Card Reward Card

Cibc Aventura Gold Visa Card The Point Calculator Gold Visa Card Visa Card Reward Card

Http Www Actexmadriver Com Assets Clientdocs Prod Preview A106rc Pdf

Rbs Reward Black Credit Card The Point Calculator Credit Card Reward Card Credit Card Offers

Rbs Reward Black Credit Card The Point Calculator Credit Card Reward Card Credit Card Offers

Ppt The Naic Risk Based Capital Formula Revisited Powerpoint Presentation Id 580600

Ppt The Naic Risk Based Capital Formula Revisited Powerpoint Presentation Id 580600

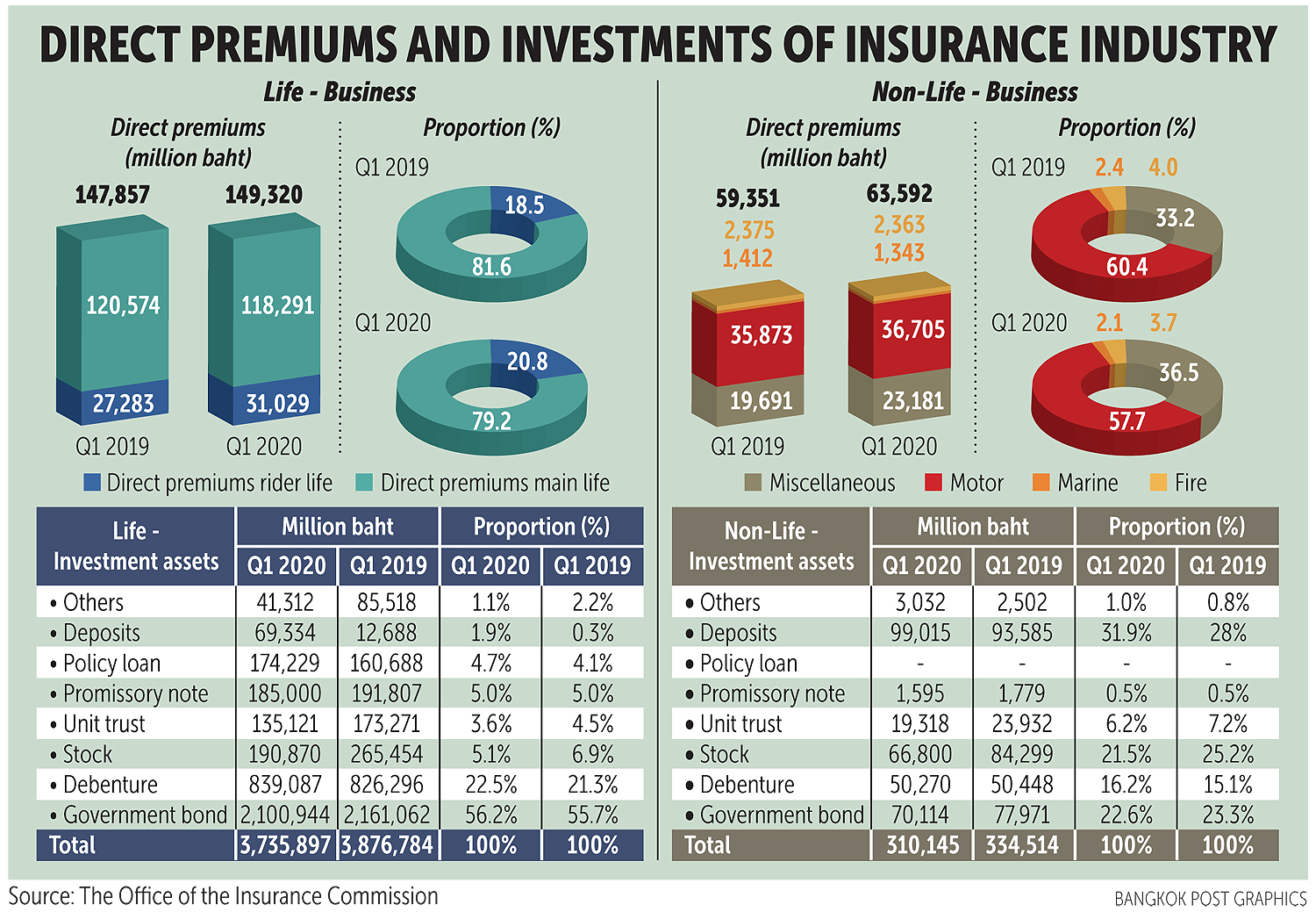

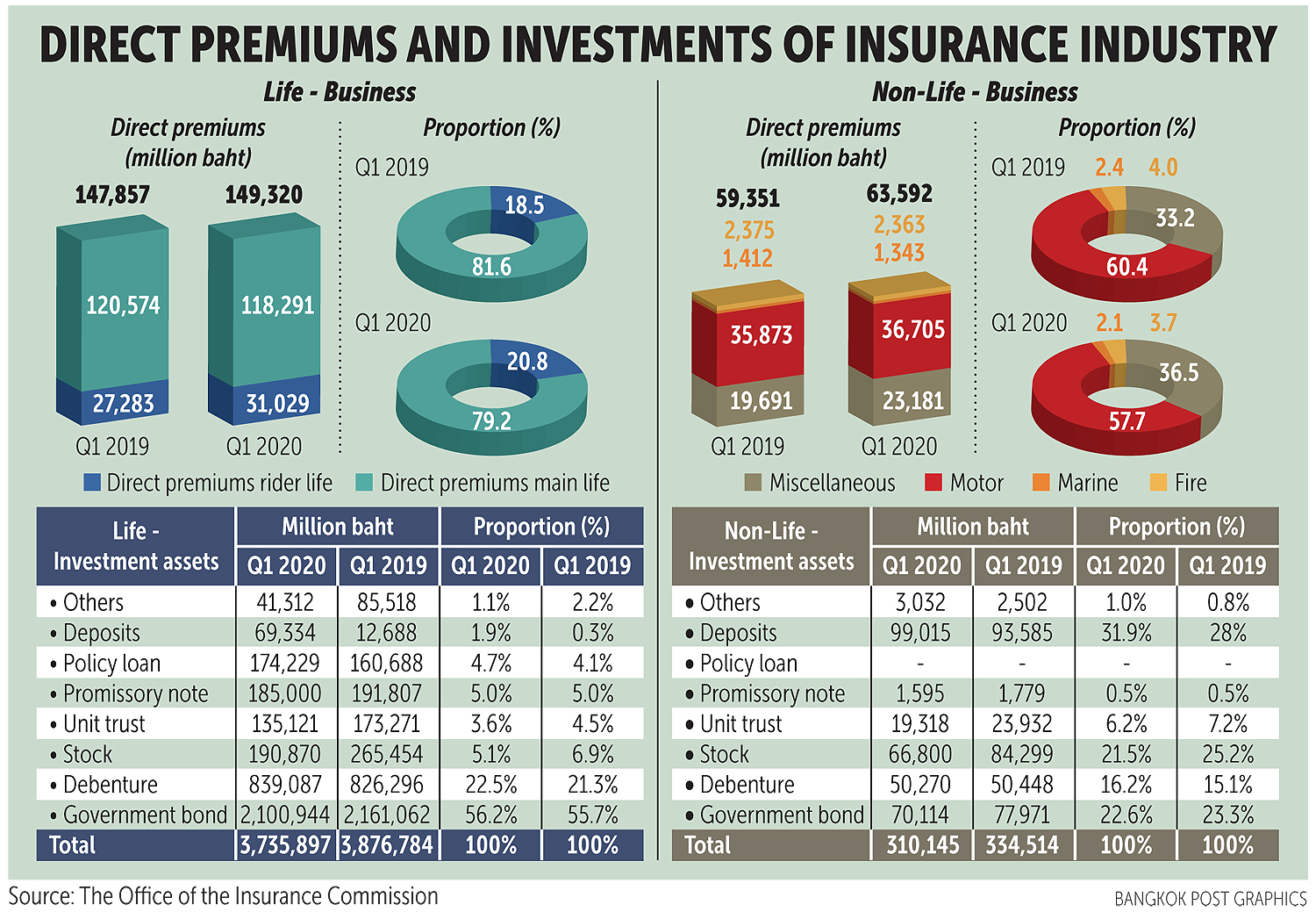

Oic Okays Revised Calculation Of Rbc

Oic Okays Revised Calculation Of Rbc

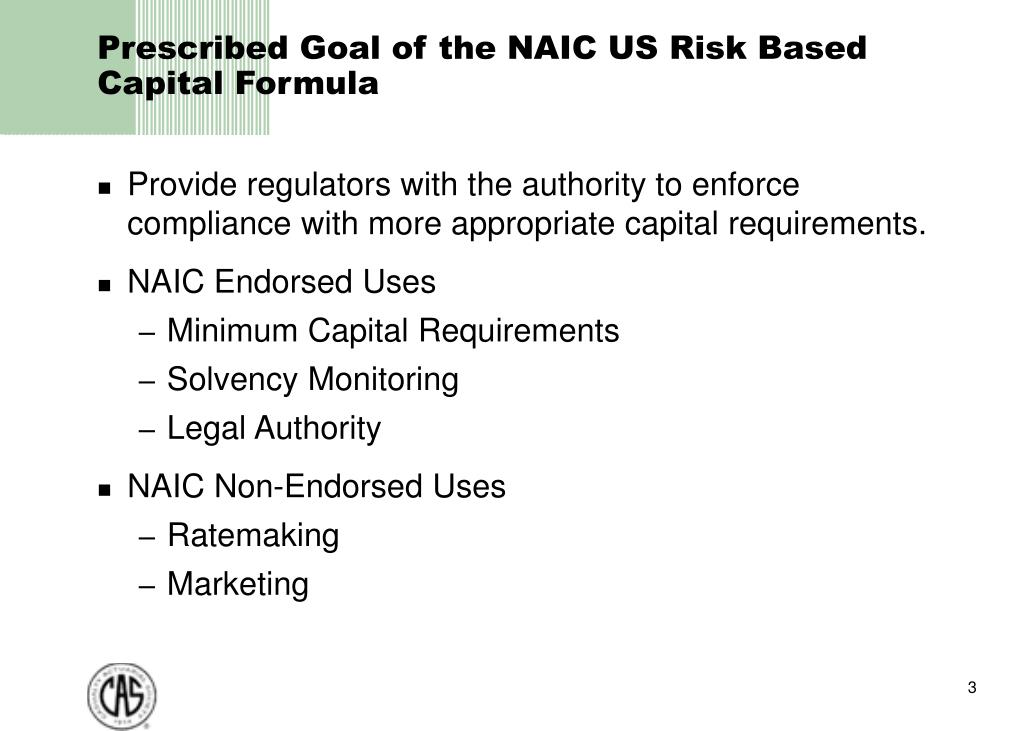

Ppt The Naic Risk Based Capital Formula Revisited Powerpoint Presentation Id 580600

Ppt The Naic Risk Based Capital Formula Revisited Powerpoint Presentation Id 580600

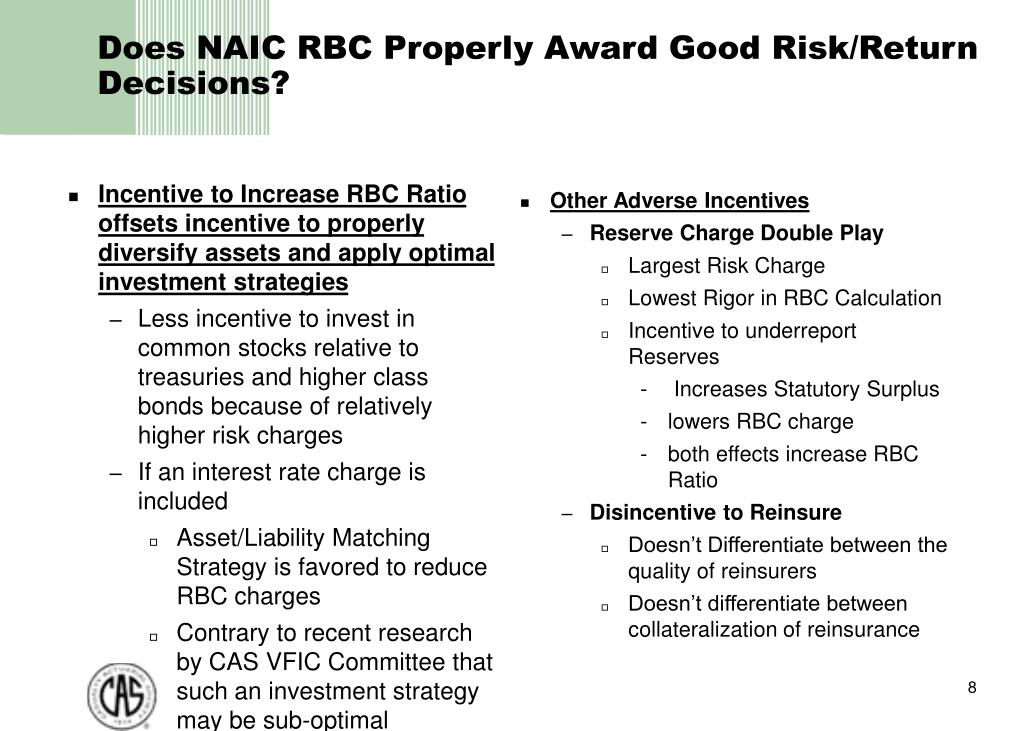

Ppt The Naic Risk Based Capital Formula Revisited Powerpoint Presentation Id 580600

Ppt The Naic Risk Based Capital Formula Revisited Powerpoint Presentation Id 580600

Ppt The Naic Risk Based Capital Formula Revisited Powerpoint Presentation Id 580600

Ppt The Naic Risk Based Capital Formula Revisited Powerpoint Presentation Id 580600

Rbs Reward Points Calculators The Point Calculator Compare Credit Cards Rewards Credit Cards Royal Bank

Rbs Reward Points Calculators The Point Calculator Compare Credit Cards Rewards Credit Cards Royal Bank

The 37 Insurance Quotes Life Insurance Quotes By Age Life Insurance Quotes Insurance Quotes Life Insurance Marketing Ideas

The 37 Insurance Quotes Life Insurance Quotes By Age Life Insurance Quotes Insurance Quotes Life Insurance Marketing Ideas

Rbc Avion Visa Platinum Card The Point Calculator Visa Platinum Card Visa Platinum Credit Card Points

Rbc Avion Visa Platinum Card The Point Calculator Visa Platinum Card Visa Platinum Credit Card Points

Anz Rewards Black Card The Point Calculator Black Card Reward Card Cards

Anz Rewards Black Card The Point Calculator Black Card Reward Card Cards

Https Math Illinois Edu System Files Inline Files Risk 20based 20capital 1 Pdf

Posting Komentar

Posting Komentar