The following items are also considered Reimbursements for tax purposes. 05122018 Is an Insurance Settlement Taxable.

Are Car Accident Insurance Settlements Taxable Adam S Kutner Accident Injury Attorneys

Are Car Accident Insurance Settlements Taxable Adam S Kutner Accident Injury Attorneys

Since youre not profiting from the insurance payout then you dont have any taxable income.

Insurance settlement taxable. 04032020 Car insurance settlement for pain and suffering taxable. Generally speaking economic and non-economic damages are not taxable but any interest you collected on the settlement is taxable. Even when a settlement becomes taxable you can often manage it in such a way to minimize or eliminate any tax burden to you or your business.

However if your pain and suffering are classified as emotional distress it is taxable and you must pay taxes on the amount paid to your attorney. Ad Search Settlement Agent. You can claim GST credits on the part of the premium that relates to business purposes.

According to the Internal Revenue Services IRS whether a car accident insurance settlement is taxable depends on what types of compensation you received and who you sued to get it. However many types of payout that you may receive as a result of a legal settlement are taxable whether the case is ultimately settled in or out of court. 14022011 Are Property Damages Settlements Taxable.

However there is a chance that you will have to pay taxes on the moneys you collect from your insurance claim depending on the specific circumstances. Itas easy to permit anxiety distractions and frustration to get from the method of owning a joyful connection but if you take a while to love and appreciate your spouse then you re establishing a habit thats full of warmth affection and attention. Get Results from 6 Search Engines.

Punitive damages are taxable and should be reported as Other Income on line 21 of Form. Interest on any settlement is generally taxable as Interest Income and should be reported on line 2b of Form 1040. 08042021 Just like a normal insurance settlement compensation for medical bills and repair of property are not taxed in a lawsuit.

Ad Search Settlement Agent. 06042020 Insurance settlement taxable For any connection to grow strong and stay strong you should add some work. You may want to consult a tax professional to determine the implications of your particular settlement but most property insurance settlements are not taxable income.

The gain is determined by comparing the proceeds to the cost of the property. Insurance is the most common way to be reimbursed for a casualty loss. 21072009 An insurance settlement isnt taxable unless you have a gain from it.

Suppose your home cost you 150000 your gain on. Any amount you may have deducted for medical expenses that were covered by the insurance settlement would be considered income as a. As long as.

1040 Schedule 1 even if the punitive damages were received in a settlement for personal physical injuries or physical. Insurance settlements You do not have to pay GST on an insurance settlement provided you tell the insurer before making the claim what proportion of the premium you can claim GST credits for. Here again any cash settlement you receive from an insurance company to restore your property to its original state does not count as taxable income.

Generally speaking moneys that businesses collect from their insurance companies after filing a claim are not considered taxable income - particularly if the amount you receive is 5000 or less. 10092008 Insurance settlements for physical injuries are not taxable. Note that if you negotiate settlement for repairs that are not required the additional money may be taxable.

The forgiven part of a Federal Disaster Loan under the Disaster Relief and Emergency Assistance Act The repayment and the cost of repairs by the person who leases the taxpayers property. Taxes vary If your pain and suffering is the result of a physical injury your award is not taxable. Get Results from 6 Search Engines.

Do I Have To Pay Taxes On My Insurance Settlement Valuepenguin

Are Workers Compensation Benefits Taxable In California Workers Compensation Attorney

Are Workers Compensation Benefits Taxable In California Workers Compensation Attorney

Are Car Accident Insurance Settlements Taxable Adam S Kutner Accident Injury Attorneys

Are Car Accident Insurance Settlements Taxable Adam S Kutner Accident Injury Attorneys

Is My Personal Injury Settlement Taxable

Is My Personal Injury Settlement Taxable

Purchase Of Insurance Policy And Cash Settlement To The Insured Australian Taxation Office

Purchase Of Insurance Policy And Cash Settlement To The Insured Australian Taxation Office

Do I Have To Pay Taxes On My Accident Settlement

Do I Have To Pay Taxes On My Accident Settlement

Is A Personal Injury Law Settlement Taxable Austin Crash Lawyer

Is A Personal Injury Law Settlement Taxable Austin Crash Lawyer

Is A Personal Injury Law Settlement Taxable Austin Crash Lawyer

Is A Personal Injury Law Settlement Taxable Austin Crash Lawyer

Is A Personal Injury Law Settlement Taxable Austin Crash Lawyer

Is A Personal Injury Law Settlement Taxable Austin Crash Lawyer

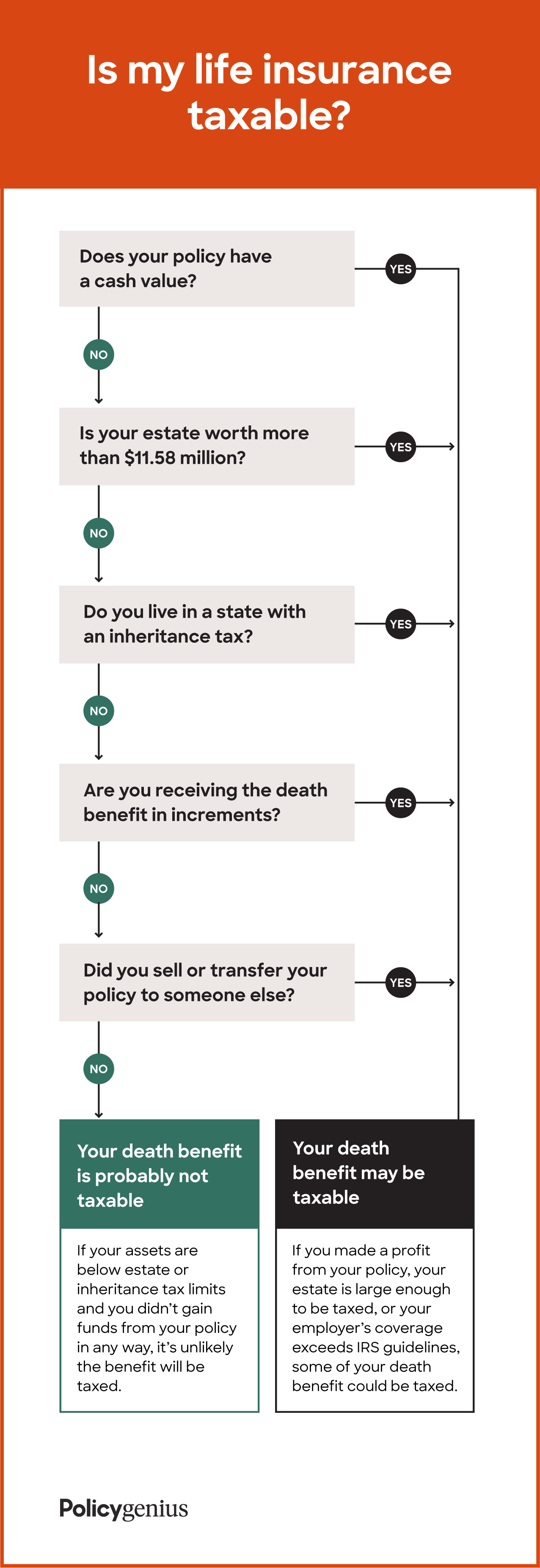

Is Life Insurance Taxable Policygenius

Is Life Insurance Taxable Policygenius

Paying Federal Income Tax On Erisa Lump Sum Settlements Monast Law Office

Paying Federal Income Tax On Erisa Lump Sum Settlements Monast Law Office

Are Car Accident Settlements Taxable The Law Offices Of Anidjar Levine

Are Car Accident Settlements Taxable The Law Offices Of Anidjar Levine

Is Workers Comp Taxable Workers Comp Taxes

Is Workers Comp Taxable Workers Comp Taxes

Taxes On Insurance Settlements

Taxes On Insurance Settlements

Is Life Insurance Taxable Forbes Advisor

Is Life Insurance Taxable Forbes Advisor

Are Lawsuit Settlements Taxable Tax Consequences Of A Legal Settlement Florin Roebig Trial Attorneys

Are Lawsuit Settlements Taxable Tax Consequences Of A Legal Settlement Florin Roebig Trial Attorneys

When Are Car Insurance Settlements Taxable Insurance Com

When Are Car Insurance Settlements Taxable Insurance Com

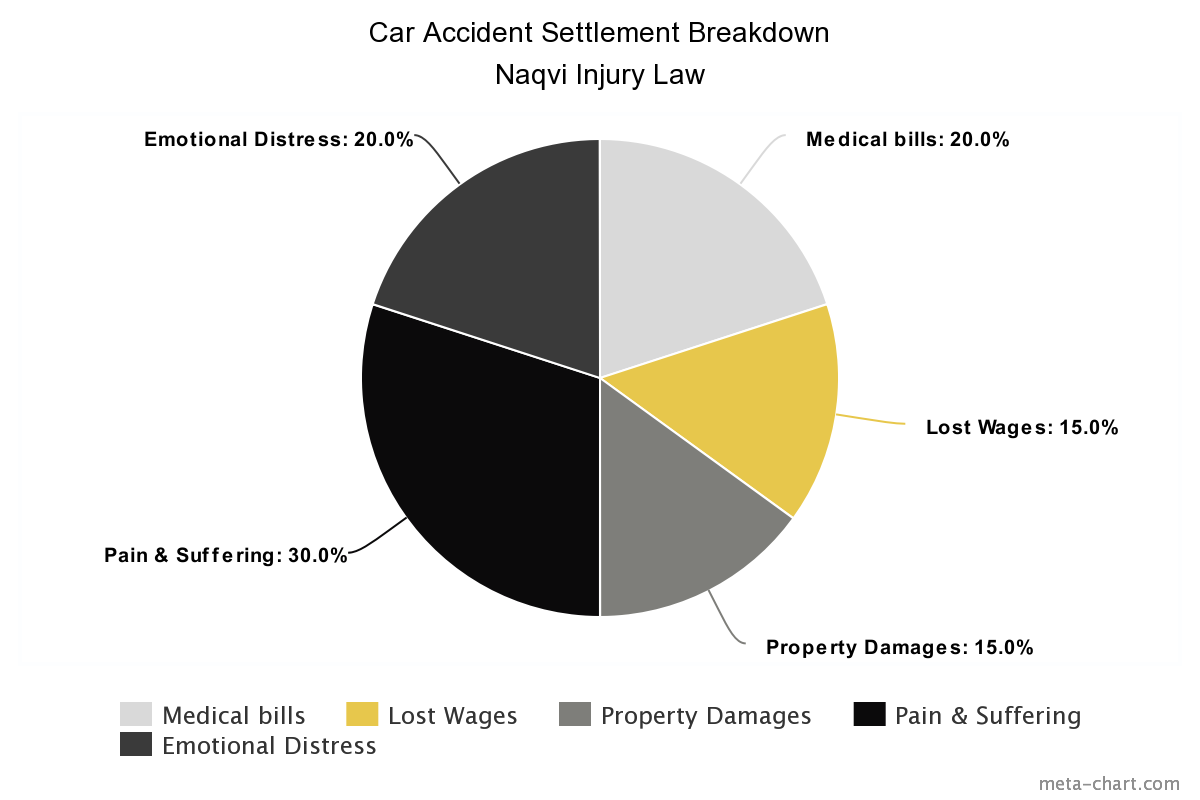

Are Auto Accident Settlements Taxable Naqvi Injury Law

Are Auto Accident Settlements Taxable Naqvi Injury Law

Are Car Accident Settlements Taxable The Law Offices Of Anidjar Levine

Are Car Accident Settlements Taxable The Law Offices Of Anidjar Levine

Posting Komentar

Posting Komentar